Learn all there is to know about Life Insurance and General Insurance.

While many things in life are left to chance, there are steps you can take to ensure you are ready for them. Insurance is an important financial choice that may help you cope with life’s uncertainties. When you get an insurance policy for yourself or your loved ones, it promises to assist you in times of trouble.

Many consumers have just a rudimentary grasp of insurance plans. You pay a premium to the insurance provider, and in exchange, they give cash compensation in the event that the covered event occurs. There are several types of insurance policies that cover diverse eventualities.

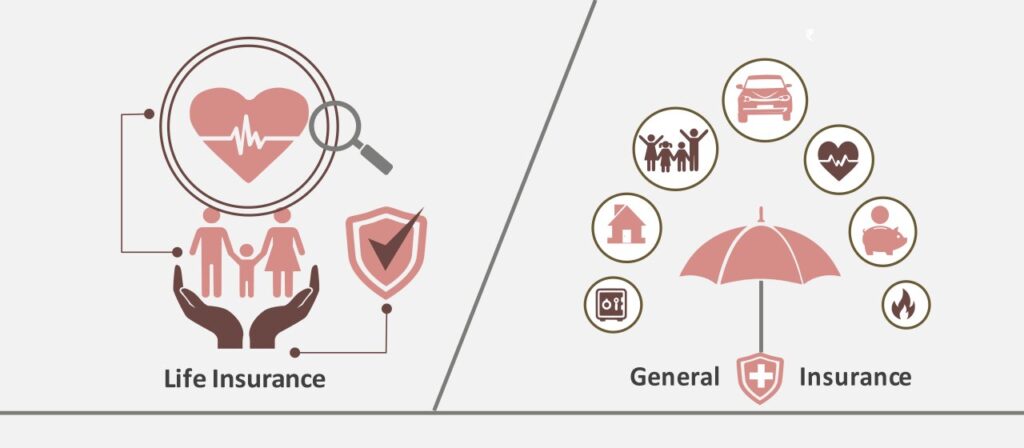

Many people are unaware that there is a distinction between life insurance and general insurance. To make wise financial decisions, it is critical to properly comprehend them.

What exactly is life insurance?

To put it simply, a life insurance policy is life protection. It is a contract that binds the insurance provider to give cash compensation to the beneficiary in the event of one of the policy’s tragic occurrences, such as the insured’s premature death. In exchange, the policyholder pays a certain sum in the form of ongoing premiums or a single payment.

The life insurance policy covers a certain length of time, and if the policyholder survives it, they are entitled to a maturity benefit under the terms of the contract. People purchase life insurance plans to give financial security in the event of unforeseen events.

More on Life Insurance: What Is It?

Life Insurance Types

1. Life Insurance (Term)

Term life insurance plans are the most basic kind of life insurance plans, providing financial protection to the beneficiary in the event that the person insured does not survive the covered time. Insurance is often chosen because it offers extensive coverage at a low cost.

Another form of term plan is term insurance with return of premium (TROP), which provides maturity benefits in addition to the death payment. It necessitates a little higher premium. It is vital to understand your individual financial needs in order to establish an appropriate premium amount.

2. Permanent Life Insurance

Whole Life Insurance policies protect the insured for the rest of their lives, or for as long as the payments are paid. It is an excellent alternative for those who want significant life insurance and want to ensure that their family is financially secure at all times.

3. Endowment Strategy

Endowment plans combine investments and insurance. A part of the premium is used to secure the amount promised, while the remainder is invested. Its objective is to accumulate funds at fewer risks while also offering financial security to loved ones over the policy period. The insured will get the money promised at maturity.

Unit-Linked Insurance Plans (ULIPs) are a kind of unit-linked insurance (ULIPs)

ULIPs enable policyholders to invest in mutual funds while also providing life insurance. It is good for long-term financial objectives since it contributes to wealth growth. Depending on one’s risk tolerance, one may invest in a variety of fund alternatives, such as equities (high risk), debt (low risk), or hybrid funds (medium risk).

Along with the death benefit, ULIPs enable partial withdrawal once the five-year lock-in period is completed, as well as transferring between funds.

5. Money-Back Guarantees

Money-Back plans pay up a portion of the money promised at predetermined intervals to the insured. These payments are referred to as survival benefits. When the insurance matures, the remaining amount of the sum guaranteed, plus with any collected bonus, is paid to the insured.

6. Child Care Arrangements

A kid plan may assist a policyholder produce cash for their child. It contributes to the formation of a corpus that may be used for a child’s education or marriage in the future. In the tragic event of the policyholder’s premature death, the beneficiary will get the amount promised.

7. Retirement Programs

A retirement plan assists you in financial planning for the post-retirement years when you may not have any source of income. In such plans, a certain sum is paid on a monthly basis to build up a corpus, which is then utilised to provide the insured with lifelong income at regular intervals following retirement.

What exactly is General Insurance?

General insurance is any coverage that protects assets and values such as a car, house, travel, and health against damage, loss, or theft, as well as a variety of other liabilities. The key distinction between life insurance and general insurance is that the latter provides financial protection against injury or loss other than death.

1 Comment

Pingback: Difference Between Life Insurance and General I...